New Jersey Vs California Income Tax . In california, colorado, kansas, new jersey, oregon, and. Are you considering moving or earning income in another state? Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Have some of the highest marginal state. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Use this tool to compare. Your average tax rate is 10.94% and your. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that.

from www.njpp.org

Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web in 2024, california, hawaii, new york, new jersey and washington d.c. In california, colorado, kansas, new jersey, oregon, and. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Have some of the highest marginal state. Are you considering moving or earning income in another state? Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Use this tool to compare.

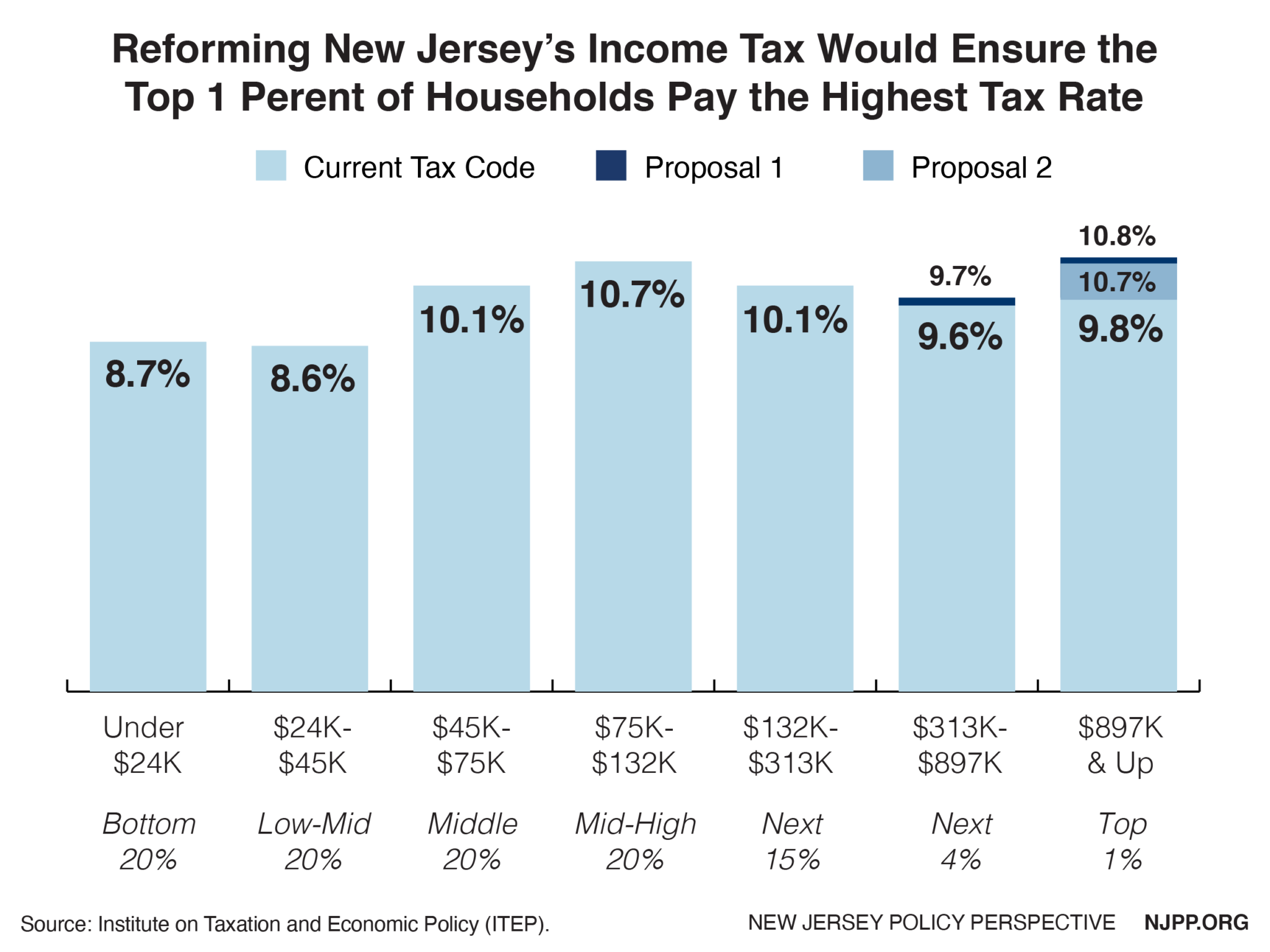

Road to Recovery Reforming New Jersey’s Tax Code New Jersey

New Jersey Vs California Income Tax Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Your average tax rate is 10.94% and your. In california, colorado, kansas, new jersey, oregon, and. Use this tool to compare. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Have some of the highest marginal state. Are you considering moving or earning income in another state? Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that.

From soquelbythecreek.blogspot.com

Creekside Chat New Jersey vs. CaliforniaThe Governor Smackdown! New Jersey Vs California Income Tax Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Have some. New Jersey Vs California Income Tax.

From printableglorygiverq5.z14.web.core.windows.net

North Carolina State Tax Rates 2024 New Jersey Vs California Income Tax Your average tax rate is 10.94% and your. In california, colorado, kansas, new jersey, oregon, and. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Use this tool to compare. Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Have. New Jersey Vs California Income Tax.

From bibiyrachael.pages.dev

2024 California Tax Brackets Table Viva Alverta New Jersey Vs California Income Tax Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. In california, colorado, kansas, new jersey, oregon, and. Use this tool to compare. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web if you make $70,000 a year living in new jersey you will be. New Jersey Vs California Income Tax.

From taxfoundation.org

New Jersey May Adopt Highest Corporate Tax in the Country New Jersey Vs California Income Tax Use this tool to compare. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Your average tax rate is 10.94% and your. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Web data are not available in delaware, where wilmington imposes a municipal income tax.. New Jersey Vs California Income Tax.

From exogkkgyw.blob.core.windows.net

New Jersey Compared To California at Marjorie Hauser blog New Jersey Vs California Income Tax In california, colorado, kansas, new jersey, oregon, and. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Use this tool to compare. Web if you make. New Jersey Vs California Income Tax.

From camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy New Jersey Vs California Income Tax Are you considering moving or earning income in another state? Use this tool to compare. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web 52 rows one simple way to rank state. New Jersey Vs California Income Tax.

From bitcoinethereumnews.com

Here are the federal tax brackets for 2023 vs. 2022 New Jersey Vs California Income Tax Your average tax rate is 10.94% and your. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for. New Jersey Vs California Income Tax.

From statgeeks.weebly.com

Irs tax brackets 2022 statgeeks New Jersey Vs California Income Tax Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Your average tax rate is 10.94% and your. Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Are you considering moving or earning income in another state? Have some of the highest. New Jersey Vs California Income Tax.

From soquelbythecreek.blogspot.com

Creekside Chat New Jersey vs. CaliforniaThe Governor Smackdown! New Jersey Vs California Income Tax Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Have some of the highest marginal state. Are you considering moving or earning income in another state? Use this tool to compare. Web data are not available in delaware, where wilmington imposes a municipal income tax. In california, colorado, kansas, new jersey, oregon, and.. New Jersey Vs California Income Tax.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview New Jersey Vs California Income Tax Web data are not available in delaware, where wilmington imposes a municipal income tax. Web california, hawaii, iowa, minnesota, new jersey, new york, oregon and vermont have the nation’s highest top state income tax rates. Use this tool to compare. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total. New Jersey Vs California Income Tax.

From gamma.app

APN Practice Regulations A Comparison of New Jersey vs. California New Jersey Vs California Income Tax Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Are you considering moving or earning income in another state? Your average tax rate is 10.94% and your. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local. New Jersey Vs California Income Tax.

From exogkkgyw.blob.core.windows.net

New Jersey Compared To California at Marjorie Hauser blog New Jersey Vs California Income Tax Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. In california, colorado, kansas, new jersey, oregon, and. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web california has a state sales tax rate of 7.25% and an average local rate of. New Jersey Vs California Income Tax.

From www.gloucestercitynews.net

LOVE YOUR MONEY New Jersey on Path to Tying for Highest Corporate Tax New Jersey Vs California Income Tax Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web if you make $70,000 a year living in new jersey you will be taxed $9,981. Have some of the highest marginal state. Web. New Jersey Vs California Income Tax.

From jaclynymarcille.pages.dev

What Are The New Tax Brackets For 2024 Uk Carmon New Jersey Vs California Income Tax Use this tool to compare. Have some of the highest marginal state. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that. In california, colorado, kansas, new jersey, oregon, and. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for. New Jersey Vs California Income Tax.

From www.templateroller.com

2022 New Jersey Member's Share of Tax PassThrough Business New Jersey Vs California Income Tax Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Are you considering moving or earning income in another state? Use this tool to compare. In california, colorado, kansas, new jersey, oregon, and. Web. New Jersey Vs California Income Tax.

From tyredmath.weebly.com

Federal tax brackets 2021 tyredmath New Jersey Vs California Income Tax Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web in 2024, california, hawaii, new york, new jersey and washington d.c. Have some of the highest marginal state. Web data are not available in delaware, where wilmington imposes a municipal income tax. Web 52 rows. New Jersey Vs California Income Tax.

From fayrebshelly-98j.pages.dev

California State Tax Brackets 2024 Tax Page Margarete New Jersey Vs California Income Tax Web data are not available in delaware, where wilmington imposes a municipal income tax. Web california has a state sales tax rate of 7.25% and an average local rate of 1.57% for a combined total rate of 8.82%. Web 52 rows one simple way to rank state tax burdens is by the percentage of all state residents' total income that.. New Jersey Vs California Income Tax.

From taxedright.com

New Jersey State Taxes Taxed Right New Jersey Vs California Income Tax Web in 2024, california, hawaii, new york, new jersey and washington d.c. Web if you make $70,000 a year living in new jersey you will be taxed $9,981. In california, colorado, kansas, new jersey, oregon, and. Use this tool to compare. Web data are not available in delaware, where wilmington imposes a municipal income tax. Have some of the highest. New Jersey Vs California Income Tax.